As a shopper, chances are you’ll use bank cards to pay for thus many purchases and actions that you just assume you need to use one to pay for a automobile mortgage. Whereas it’s potential in a restricted variety of circumstances, it’s not permitted in most, particularly on a recurring foundation.

Because it seems, the reply to this query is fairly sophisticated. Although there could also be instances when paying a automobile mortgage with a bank card might be executed– and it could even make sense financially–it’s removed from being a typical follow. In case you’ve not too long ago taken a automobile mortgage, one of the best technique is to not plan on utilizing your bank cards to pay your automobile mortgage.

The quick reply is sure, however with plenty of limitations. First, whereas the follow could also be permitted by bank card issuers, it’s hardly ever welcomed by auto lenders—particularly relating to making month-to-month funds. Bank cards cost retailers processing charges of as much as 3.5% on funds, which is why automobile lenders frown on bank card funds.

In case you are contemplating utilizing a bank card to make a automobile mortgage fee, contact the cardboard issuer to ensure it’s permitted. Much more importantly, attain out to the automobile mortgage firm to search out out in the event that they settle for bank card funds, and what the procedures are in the event that they do.

However aside from the limitation of constructing automobile funds, there could also be different conditions the place you need to use a bank card in reference to a automobile mortgage.

One distinguished instance is utilizing a 0% introductory APR stability switch provide to repay the remaining stability on a automobile mortgage. Some bank card firms provide this introductory profit for between 12 and 21 months. In case you can repay a remaining automobile mortgage stability utilizing this provide, after which repay the stability switch inside the interest-free timeframe, a bank card is usually a good technique.

Not surprisingly, a whole class of bank cards is offered particularly for the automobile trade. Main auto producers have partnered with banks to supply bank cards that present rewards that can be utilized for the acquisition of recent or used automobiles. The rewards are fairly beneficiant, providing hundreds of {dollars} towards the acquisition of a brand new automobile. We’ll be masking a few these playing cards on this information.

Generally, nevertheless, the flexibility to make use of a bank card to buy a automobile might be severely restricted by the credit score restrict on the cardboard. Not solely is there an general credit score restrict on every bank card, however there’s often a decrease restrict set for stability transfers and money advances. With the common worth of a brand new automobile now effectively in extra of $40,000, a bank card is more likely to characterize not more than a partial fee on the acquisition of a brand new automobile.

Paying off a automobile mortgage with a bank card: Execs & Cons

Advantages

- Utilizing a bank card to make an occasional month-to-month fee could also be a solution to keep away from defaulting on the automobile mortgage when funds are tight.

- A bank card is usually a good technique for paying off a automobile mortgage if in case you have a 0% APR stability switch functionality, and you’ll pay the stability in full earlier than curiosity begins to use.

- Through the use of a bank card to repay the stability on the automobile mortgage, you’ll be eradicating the lien in opposition to the automobile, stopping potential repossession.

Dangers

- Utilizing a bank card to pay a automobile mortgage solely replaces one debt with one other; it doesn’t decrease your general indebtedness.

- The rate of interest could also be increased on the bank card than on the automobile mortgage you’re paying off.

- It’s possible you’ll be swapping a fixed-rate mortgage for a variable-interest bank card.

- Most auto lenders received’t settle for month-to-month funds on a bank card.

- Whether or not you might be utilizing a stability switch or a money advance, it’s possible you’ll pay an upfront payment for the privilege.

- Your capacity to make use of a bank card towards a automobile mortgage might be restricted by the credit score restrict in your card.

- Utilizing a bank card to pay a big mortgage, like a automobile mortgage, can elevate your credit score utilization ratio, inflicting your credit score rating to drop.

- You’ll be changing a time period mortgage with a particular time restrict with a revolving line that would stay excellent for years.

Which bank cards can be utilized to make automobile funds?

We’re together with bank cards beneath that can be utilized for the acquisition of a automobile, the payoff of an current mortgage stability, to make a month-to-month automobile fee or any mixture of the three.

My GM Rewards® MasterCard®

- Common APR: 19.99% – 29.99% variable.

- 0% introductory buy APR: 12 months for purchases; stability transfers not indicated.

- Stability switch payment: Not indicated.

- Money advance payment: None.

- Money advance APR: 29.99%.

- Money again rewards: 7x factors for each $1 spent on GM purchases, and limitless 4x for each $1 spent on all different purchases.

- Annual payment: $0.

Simply as there are bank cards issued for particular retailers and journey firms, there are additionally bank cards devoted to the auto trade. One distinguished instance is My GM Rewards® MasterCard®, issued by Goldman Sachs.

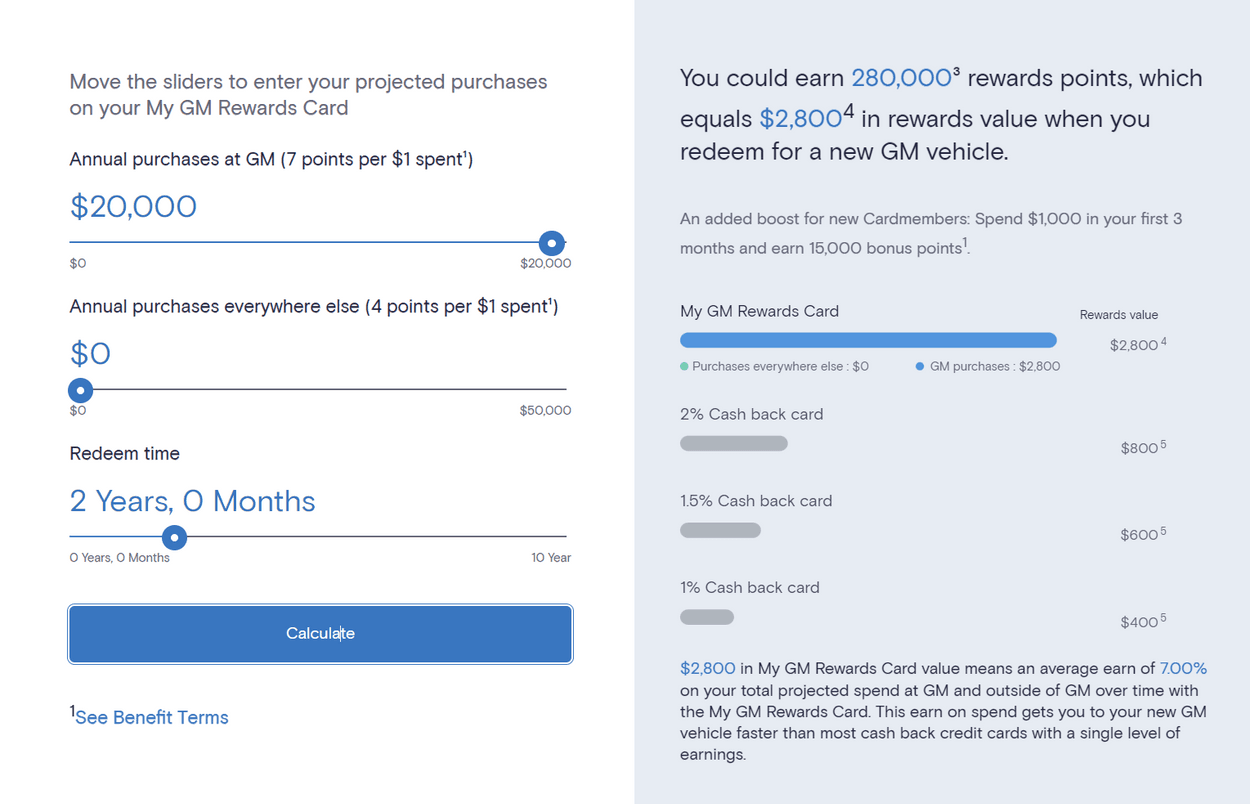

As you may think, the cardboard is designed particularly that can assist you to buy a GM automobile. That begins with awarding 15,000 bonus factors if you spend a minimum of $1,000 inside the first three months of opening your account. That’s accompanied by a 0% introductory APR on purchases for 12 months. Nevertheless it will get higher.

If you buy a GM automobile, you’ll earn seven factors for every greenback spent. For instance, you’ll be able to earn as much as 280,000 factors—value $2,800—if you spend a minimum of $20,000 towards a brand-new GM automobile. Rewards factors amassed from different purchases can be used for the acquisition of a brand new GM automobile.

You may as well redeem factors value as much as $1,000 for the acquisition of a licensed pre-owned automobile.

The My GM Rewards® MasterCard® doesn’t present a stability switch provision. Nevertheless it does provide money advances, which can be used to make your automobile fee. In case you do, the APR might be a steep 29.99%, although there isn’t a money advance payment charged.

Toyota Rewards Visa® Credit score Card

- Common APR: 20.99% – 29.99% variable.

- 0% introductory APR: Not provided.

- Stability switch APR: 26.99% variable.

- Stability switch payment: Better of $10 or 5% of every stability transferred.

- Money advance payment: Better of $10 or 5% of every money advance.

- Money advance APR: 31.99% variable.

- Money again rewards: 5x factors for each $1 spent at Toyota; 2x on gasoline, eating, and leisure; 1x for each $1 spent on all different purchases.

- Annual payment: $0.

Toyota provides the Toyota Rewards Visa® Credit score Card which might equally be utilized in reference to the acquisition of one in all its automobiles. The cardboard is issued by way of Comenity Capital Financial institution. Rewards factors might be redeemed on service, elements, equipment, and towards eligible Toyota automobile purchases.

The cardboard additionally provides a stability switch functionality, however it’s topic to each a excessive APR and a stability switch payment. Because of this, a stability switch utilizing this card to repay an current automobile mortgage might not make monetary sense. It might even be potential to make month-to-month automobile funds utilizing the cardboard, however there’s a excessive APR and money advance payment right here as effectively.

The first objective of this card can be the redemption of rewards factors for the acquisition of a brand new automobile.

Options to utilizing a bank card to purchase a automobile

Financial savings

Based on Kelly Blue E-book, the common value of a brand-new automobile in 2023 is $48,528. It will be a stretch for the common particular person to give you that a lot money to pay for a automobile. However if you’re able to take action, you get rid of the burden of a month-to-month fee, and personal your automobile debt free.

Commerce-in your present automobile

Simply as the price of new automobiles has risen, so has the worth of used automobiles. Which means your present automobile could also be value greater than you suppose. And that may characterize a considerable trade-in in your subsequent automobile. It in all probability received’t cowl the total value of the brand new automobile, however it is going to end in a a lot decrease mortgage quantity.

Take a private mortgage

A private mortgage is usually a viable different to utilizing a automobile mortgage to buy a automobile. The charges on private loans vary between 5.99% and 35.99%. They’re typically increased than the charges on automobile loans as a result of they’re utterly unsecured. And plenty of private mortgage lenders cost origination charges that may vary between 1% and 10% of the mortgage quantity.

However private loans have the benefit of enabling you to both buy a automobile or repay an current automobile mortgage in a method that may allow you to personal your automobile free and clear.

Private loans are extensively accessible at banks and credit score unions, however the mortgage quantities are usually no various thousand {dollars}. Bigger quantities can be found by way of on-line private mortgage lenders, resembling LendingClub and Upstart, which supply private loans of as much as $40,000 and $50,000, respectively. Even bigger quantities can be found by way of Lightstream, which provides loans as much as $100,000.

Refinance into one other automobile mortgage

For a lot of shoppers, the true drawback of a automobile mortgage isn’t the mortgage itself, however a really excessive rate of interest that leads to a crushing month-to-month fee. This might have been the result in case you had less-than-perfect credit score on the time you made the unique buy. In case your credit score has improved since, one of the best technique could also be to refinance right into a brand-new mortgage.

Nationwide lenders specializing in automobile mortgage refinances embody the next:

TIME Stamp: Principally, don’t pay a automobile mortgage with a bank card

Paying a automobile mortgage with a bank card is sensible in a small variety of circumstances, after which just for a brief time period. For instance, if utilizing a bank card to make a month-to-month automobile fee will stop your automobile mortgage from going into default, it could be definitely worth the effort. And if in case you have a really excessive rate of interest in your automobile mortgage and might change it with both a 0% stability switch or a bank card with a decrease price, this may occasionally even be a sensible technique.

However usually, the follow ought to be averted. Bank cards sometimes carry increased charges than automobile loans and require excessive charges to entry the funds. You’ll even be changing one type of debt with a set rate of interest and fee with one other that has a variable price, and no particular timetable for payoff.

In abstract, utilizing a bank card to pay a automobile mortgage has the potential to show a brief drawback right into a long-term headache.

Ceaselessly requested questions (FAQs)

Do all bank cards can help you make automobile funds?

Many bank cards will allow you to make automobile funds, however they are going to be thought-about money advances. Which means they’ll carry the very best rate of interest and are available full with an upfront money advance payment.

In case you’re uncertain whether or not your bank card issuer will allow automobile funds, contact customer support. Much more essential is to contact the automobile mortgage firm to study if it accepts bank card funds. Most don’t.

Does it make sense to finance the whole value of a automobile with a bank card?

Usually, no. Bank cards practically at all times have a better rate of interest than automobile loans. However they’re additionally a type of variable-rate financing, with an indefinite compensation time period that may go on for a few years. And for many shoppers, the credit score restrict on a bank card might be inadequate to buy a automobile.

One of the best use of a bank card in reference to automobile financing could also be both to make a down fee or to repay a remaining automobile mortgage stability. It might make sense provided that it may be executed with a 0% APR provide on a bank card. And even then, it ought to be executed provided that the stability switch might be paid off earlier than curiosity applies on the cardboard.

Why can’t I exploit my bank card to pay my automobile fee?

Even when your bank card issuer permits it, your auto lender might not. Bank cards cost service provider charges ranging between 1.5% and three.5%. Consequently, automobile lenders won’t obtain full fee after the charges are deducted from the remittance they obtain from the bank card issuer.